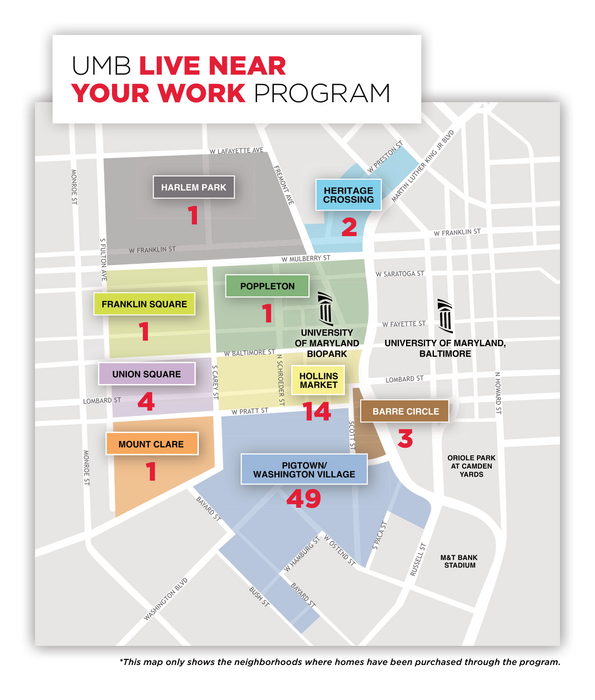

Live Near Your Work is capitalizing on its success by adding two neighborhoods with historic significance: Druid Heights and Heritage Crossing.

Live Near Your Work

Live Near Your Work Program Expands

Make your dream of homeownership a reality

Join the already 63 employees who have benefited from over $1 million in grants, including Justin Hanna, facilitates manager at the School of Social Work.

Employee Tara Wells Purchases Home in Pigtown

Urged by School of Nursing Dean Jane M. Kirschling to pursue the LNYW Program, Department of Organizational Systems and Adult Health program administrative specialist Tara Wells purchased a rowhouse in Pigtown.

Explore Neighborhoods

The Live Near Your Work (LNYW) Program is an initiative between UMB and key community partners that focuses on community revitalization and stabilization in targeted West Baltimore neighborhoods. LNYW benefits UMB employees by offering homeownership down payment and closing cost assistance on newly purchased homes while also demonstrating commitment to the community.

UMB will contribute $16,000 per eligible participant. In addition, participants will be eligible to receive a matching grant of up to $2,500 from the Baltimore City Live Near Your Work Program.

You also may qualify for additional grants outside of UMB toward your home from programs.

Explore Eligible Neighborhoods

Upcoming Events

News

UMB Receives ‘PR News’ 2019 Nonprofit Award

The University of Maryland, Baltimore (UMB) received PR News’ 2019 Nonprofit Award for Employee/Internal Communications for its Live Near Your Work (LNYW) program campaign. The Office of Communications and Public Affairs (OCPA) accepted the national award on behalf of UMB administration, Human Resource Services, the Office of Community Engagement, and the LNYW subcommittee.

Why Live in Baltimore?

Baltimore is a vibrant city that continues to evolve and welcome new residents. This is especially true of LNYW’s qualifying neighborhoods, which boast an unrivaled sense of community and intimacy without sacrificing diversity or dynamism.

Purchasing a home in a qualifying neighborhood allows UMB employees to:

- Become involved in active and ever-growing communities.

- Shorten lengthy commutes to work.

- Live within walking distance of restaurants, stores, stadiums, and cultural centers.

- Choose from a variety of housing types, ranging from historic rowhouses to newly constructed condos.

Interested in UMB’s LNYW Program? See if you are eligible or contact us for more information.

Contact

Compensation, Benefits, and Well-Being

620 W. Lexington St.

Third Floor

Baltimore, MD 21201

Benefits

HRBenefits@umaryland.edu

Compensation

HRComp@umaryland.edu

Well-Being at UMB

HRWell@umaryland.edu